By: Tom Coffey, Senior Director, Valuations Systems, and Alfonso Porras, Associate Vice President, Valuation Solutions, on behalf of CostQuest Associates.

In a previous article, we highlighted the key drivers in telecom network valuations – capital costs, revenues, operation costs, and risks. With billions of federal broadband funding coming and internet usage at an all-time high, we’re now going to analyze the publicly traded network companies on the stock market so you can see:

- How network valuations are changing across the industry

- Some of the key factors driving these changes in network valuations

- What changes in network valuations mean for your broadband network value

To quickly summarize, for the top broadband companies, some factors impacting network value are:

- Pricing

- Competition

- Interest Rates

- Network Build Costs

What does this mean for the remainder of the broadband market? Small to mid-size broadband companies may have more opportunities.

The Current State of Public Broadband Company Valuations

To assess the current state of the largest public broadband company’s performance, let’s examine their market capitalizations (equity) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

Before we dive in, note that markets are highly dependent on economic conditions and investor sentiment, so it is important not to read too much into these figures from an industry standpoint. Recent increases in interest rates make debt more expensive, impacting valuations across all industries and altering current and future prospects. Individually, each of these companies will have its specific situations that may not match the dynamics for smaller broadband companies.

The data in the table below show that stock prices are down, with stagnant and decreasing values over the last few years. With multiple rounds of funding and increasing broadband usage, the decline in network valuations for communications companies is counterintuitive.

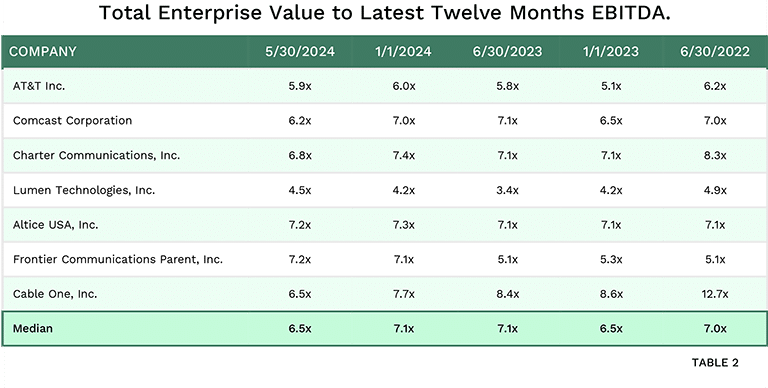

A second way to analyze these companies’ performances is to look at earnings multiples, or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). EBITDA multiples take the company’s value (debt and equity) and divide it by its annual earnings.

In each company’s EBITDA (the table below), we see a more consistent story but still declining valuation metrics. Market prices are supposed to be looking forward to industry prospects. The outlook is steady overall, with high capex spend and stable customer counts.

Our take is that these network valuations may be highly influenced by macroeconomic factors. Given the current economic environment, investors could be more focused on high-growth industries.

However, a well-managed broadband company will still produce consistent returns and deliver value to shareholders, employees, and customers. Therefore, smaller to mid-size broadband companies may have much higher growth potential.

Pricing Factors Impacting Network Valuations

Future broadband growth will be largely driven by federal funding dollars, which target areas that would otherwise not be profitable for expansion. So now, revenue growth becomes a question of pricing and avoiding churn.

For years, large parts of the country did not have access to broadband services, and many profitable service areas were underserved with DSL or limited HFC services. The demand for higher internet speeds has driven telecom companies to spend heavily updating their existing networks and building new networks where the density of potential customers made it economically viable to continue building.

Now, most profitable areas (urban and suburban) have multiple providers that can supply broadband services, and customer growth in these areas has stagnated.

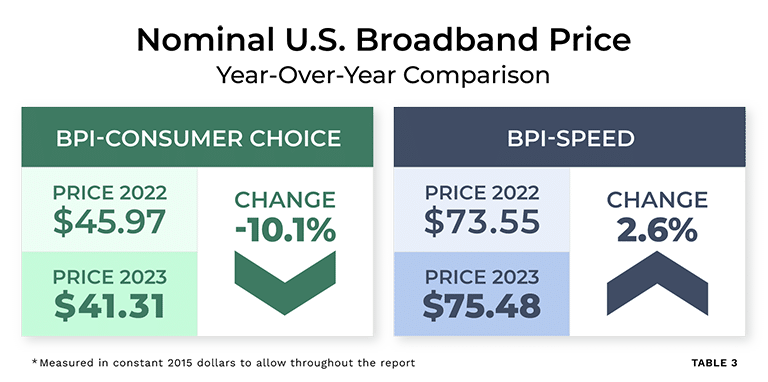

In terms of pricing, the 2023 Broadband Pricing Index shows that broadband prices are going down for many consumers. The customers paying for the highest internet speeds have seen marginal price increases and are receiving significantly higher speeds than in 2015, while other speed tiers have seen price decreases.

The disparity in pricing makes it crucial to understand what type of services and speeds your competitors are providing in your network footprint or in areas you may be looking to expand your network into.

This information can be found in the Broadband Data Collection (BDC) data – the database reflecting broadband service availability for each of the 115+ million Broadband Serviceable Locations in the US.

Competition from Mobile and Fixed Wireless Providers

The competition from wireline providers has intensified as every major provider continues to build fiber. However, mobile companies continue to expand 5G services and have entered the broadband market with fixed wireless products. Will fixed wireless seriously threaten broadband revenues?

Right now, the answer seems to be “no”. However, fixed wireless has significantly higher customer satisfaction than legacy services, even when the legacy services are better. Consumer sentiment can change quickly, and it is possible that the excitement over having a new option will fade over time.

Additionally, fixed wireless requires the use of mid-band spectrum. As wireless companies continue to see increased demand for their 5G mobile service, will they be able to grow and maintain the speeds for fixed wireless?

T-Mobile remains the leader in the 5G market and remains unchanged in its goal of 7-8 million subscribers by the end of 2025. Capacity and growth in data usage will keep that market challenged and limit growth.

What about consumers who are ‘smartphone-dependent,’ meaning they own a smartphone but do not subscribe to a high-speed home broadband service? According to the Pew Research Center, this accounts for 15% of adults and has remained constant in recent years, and this share is greater among those with lower incomes.

The data indicates that this is not a growing segment. The socioeconomic indicators suggest that if the economy does well, this number could decrease, opening a window for providers to add customers. If the opposite happens and more households are pushed into lower-priced services, we could see more consumers canceling their broadband service.

Therefore, careful consideration of the competitive landscape in terms of the type of technology and carrier presence, along with the socioeconomic demographics, consumer behavior, and take rate potential in each market, is critical to generating a clear financial assessment of a network company’s value and growth potential.

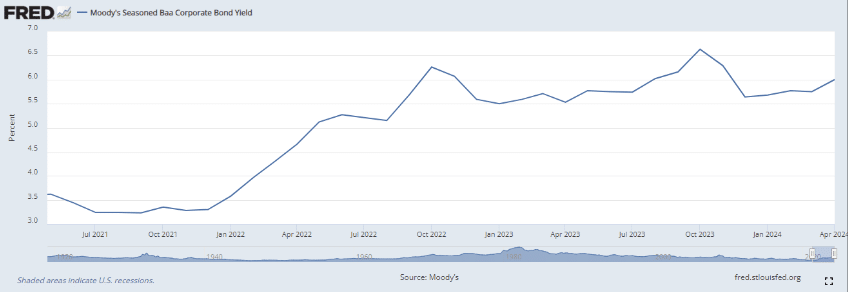

Interest Rates in the ‘Golden Age’ of Private Credit

Interest rates drive the economy, and many telecommunications firms will fund their expansion with a combination of debt and equity, along with refinancing. Increases in interest rates can greatly impact profitability and the ability to continue raising capital. After years of record-low interest rates, rates have risen to more historical averages.

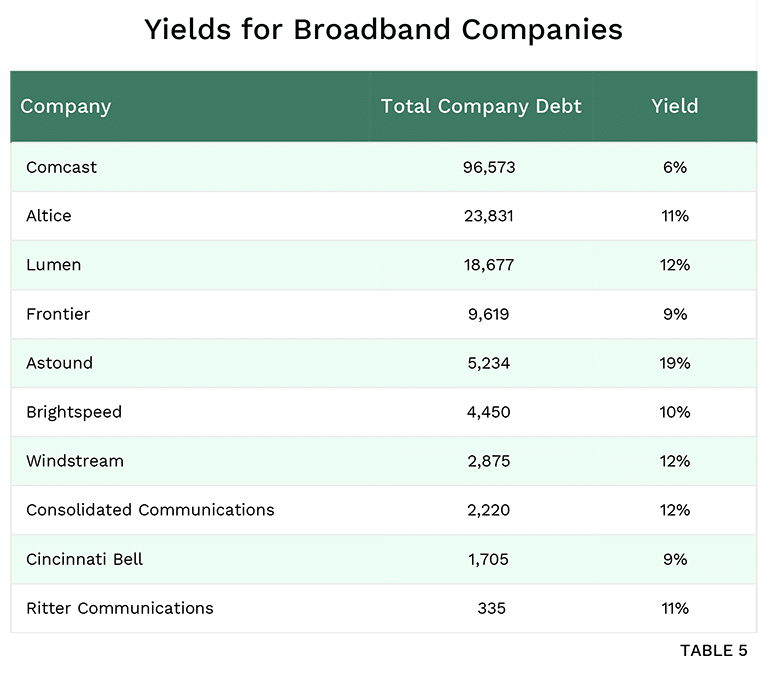

Below are the current yields for a few selected broadband companies:

Most of these rates are on the lower end of what we’ve seen for smaller broadband companies. Many factors influence yields, such as the length of the bond (duration).

The private credit market has flourished in recent years as it has filled an important niche for investors, providing high risk-adjusted rates of return separate from public markets. There is strong interest from private investors to fund telecom companies in many different structures. Federal broadband dollars will provide a form of capital leverage.

The current yields and other details for certain Comcast bonds are also available from sites like Market Insider. There are also public sources like the Federal Reserve Bank’s published data on Baa Corporate Bond Yield.

The estimates from the Federal Reserve are that interest rates will gradually decrease over the next few years, but this variable is impossible to forecast with high certainty.

Network Build Costs Are Increasing

The challenge of building a network varies by company history, and each situation provides its challenges. Especially when build costs have increased over the past few years.

Let’s walk through three scenarios, their challenges, and the effects of increasing costs for each:

Scenario 1: Legacy telephone companies that provide services, like DSL and POTS, over copper simply do not provide adequate services to compete in the market. They are saddled by the legacy copper network while continuing to build a fiber network, creating the challenge of operating and maintaining two networks.

Scenario 2: Cable companies with Hybrid Fiber Coaxial (HFC) networks can leverage the fiber in their network to upgrade customers to higher service tiers, but are ultimately still required to push fiber closer to the end customer.

Scenario 3: New providers must build their network but are limited by maintaining an outdated network.

In Scenario 1, legacy telephone providers are at high risk of having a new competitor overbuild their aging network, and the cost of maintaining a copper network limits how much money can be spent on building more fiber.

In Scenario 2, cable providers can upgrade HFC customers to compete at a lower cost, but ultimately, they can’t avoid eventually expanding fiber in their network. The result is that cable providers can spend less money now, but over time, they will end up spending more to upgrade customers and are still at risk of being overbuilt by a fiber provider.

In Scenario 3, new providers are limited by the time it takes to build a network, and being first to market is crucial to success. Existing providers can attempt to improve and upgrade their network by upgrading equipment. There is also the challenge of other new providers looking at the market. If the market is attractive to you, it will be attractive to others as well.

The risk faced by each type of provider in all three scenarios is heavily affected by the increasing costs of network builds. Ultimately, a network company’s success will be measured by its ability to recover the cost of building its network and provide an adequate return to its investors or other stakeholders.

Developing Network Cost Models

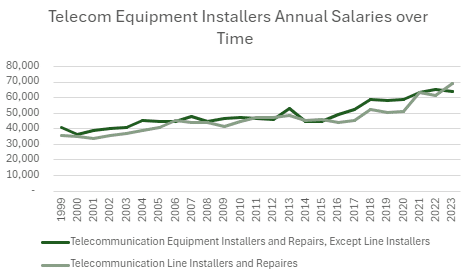

By many metrics, build costs have seen meaningful increases in the past few years. Companies that are constantly building and using internal workforces will have a good understanding of how labor and materials costs are changing. There are also some public sources that show how these costs have changed as well. The U.S. Bureau of Labor Statistics publishes a list of telecommunications related salaries based on thorough surveying of companies:

Above, we present the annual salaries on a national basis; data is available for specific regions on an hourly basis, and even an estimate of the number of individuals employed in the profession in that area.

From our perspective, when developing our Network Cost Models, we look to account for all factors that go into the cost of building a network to every broadband serviceable location in the country. These cost models consider regional labor rates, cost of materials, a fully engineered network design with logical route and equipment placements, total consumer demand, and underserved and unserved demand across the country.

To prove the economic viability of the network build, we can model market share, average revenue per customer (ARPU), and the Net Present Value (NPV) of the build, considering what we know about the costs to build in each market. CostQuest’s National Cost Models have been used in federal programs such as the NTIA’s BEAD and the FCC’s USF programs, and these models can act as an important starting point in your financial models.

As mentioned before, companies that are actively building have a good understanding of the costs associated with their network builds. The inputs in our national models are easily customizable to become even more specific to a carrier’s situation. We can easily incorporate your labor and materials costs, infrastructure placement, service prices, and so on into our cost and business case models.

What does this mean for my network valuations?

If industry and economic factors are favorable in the coming years, private and federal investments will grow the value of broadband companies. If these factors are unfavorable, the industry will see struggling, overextended companies go through bankruptcy and be the target of acquisitions.

So, how should smart broadband companies position themselves?

- Understand your base case as you expand your network: Bringing together a precise assessment of network build costs and the expected return in the coming years will give you a Net Present Value (NPV). CostQuest’s Network Models calculate NPV for every location in the United States using a variety of assumptions in its dataset, and you can work with reliable data from engineering and financing teams. Make sure estimates are consistent across parties, so there is no miscommunication about the outlook.

- Consider a variety of outcomes: We’ve highlighted a few key variables like build cost, pricing/ARPU, competition, and interest rates. Understand the range for each of these and the impact that will have on the business. Remember that many of these factors are related; a poor economy will drive interest rates up, put pressure on pricing, take rates, and churn.

- Don’t over-extend: Broadband is a stable industry that will produce consistent returns in the long term. Investors should not expect high technology returns. Ensure that your company can withstand adverse conditions to secure positive outcomes for investors, employees, and customers.

To stay ahead in the evolving market of network valuations, keep in mind these factors driving changes to network valuations:

- Interest rates are on the rise, making debt more expensive.

- Increases in interest rates can greatly impact profitability and the ability to continue raising capital.

- Federal funding is driving future broadband growth in less profitable areas. Revenue growth becomes of question of pricing and customer churn.

- High competition in densely populated and profitable areas, and socioeconomic factors influence service adoption.

- Increasing network build costs, including labor, materials, etc.

Broadband companies operate in a dynamic and competitive environment where economic and industry conditions can rapidly change. To thrive, it’s essential to stay informed and adaptable. By understanding current market dynamics, assessing potential risks, and strategically planning for various outcomes, companies can optimize their network value for sustainable growth.