By: Stephen Mok, Director of Innovation at CostQuest.

Contributor: Bob Garringer

CostQuest has extensive experience in the development of forward-looking cable TV costs for property taxation purposes. Our experience developing replacement cost studies for our clients provides our staff with unique opportunities to analyze the trends in replacement costs over time. Developing cost trends for a cable network requires not only significant experience in the subject matter but also the data needed to evaluate changes in both equipment and installation costs and methods over time.

A cable provider’s network essentially consists of cable, structure (poles, conduit, trenching), electronics, customer premise equipment, buildings, and land. Each of the identified network components require both material investment and installation (labor) investment to place in service. Over time, some of the identified components may increase in total placement cost, such as cabling, while others, such as electronics, decline in total placement cost. Equally as important as the raw change in purchase cost, if not more so in the case of electronics and customer premise equipment, is the change in productivity/efficiency of the equipment. It is also important to note the impact of shifts in the types of services provided over that network, such as video services versus broadband services, that affect the cost per unit of service delivered. For example, the replacement of coax with fiber cables deeper into the network, changes in installation methods which reduce installation cost and increase labor productivity such as microtrenching for buried cable placement, and increased capacity of electronics must be considered developing the overall cost trends of providing cable and broadband services. Additionally, the mix of services provided by a cable provider’s network are changing resulting in changes in the makeup of the network and changes in the replacement cost of that network. In the past, cable networks focused on providing Video their entire franchised area. Today, penetration rates for video services are only holding steady or declining while high-speed IP-based broadband services and build costs are the major drivers of investment.

CostQuest sees evidence of the overall decline in the costs of building a new cable network when reviewing several years of its Replacement Cost New (RCN) calculations for property tax valuations. Many states assess cable property value by first determining the “replacement cost new” of the network. This value represents the investment necessary to build a functionally equivalent new network using the latest available technologies. This replacement network includes the current material and installation costs required using the current technologies and installation methods available at the time the analysis is developed. A complete replacement analysis of a cable network would reflect changes in not only raw material and installation costs, but also changes in the demand and mix of services provided, changes in more efficient technologies and improved installation methods as new technologies are developed and deployed.

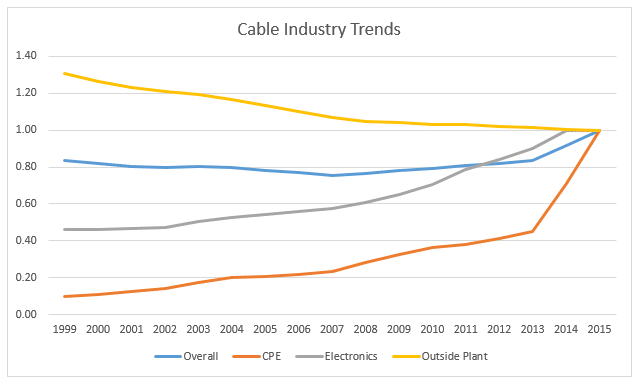

Below is an overview of changes in the replacement cost of the overall cable provider’s network and selected significant components of a cable network. The index, using 2015 as the base year with a replacement value of 1, identifies the relative replacement value of equipment placed in service from 1999–2015. It is important to note that each line on the graph with an upward slope from left to right is indicating a negative replacement cost trend. Keep in mind that this chart indicates a significant decline in replacement value ratio from the base year of 2015, for CPE (customer premise equipment) and electronics during the study period.

This overall change in costs over time gives one a perspective of the expected trend in future RCNs and provides insight into whether a carrier may benefit by using CostQuest’s replacement cost models and processes in the production of a more accurate value opinion for property tax appraisal purposes. But, as noted above, the cable network is made up of many components — electronics, structure, and cable – and all require both material investments and labor investments. So, while an overall trend in replacement costs is useful in planning for certain analyses such as property taxes, just understanding the overall trend in costs may not be appropriate for all uses.

Other trends which may be of value in planning/analysis include trends in labor costs, trends in electronics on a productivity unit basis (e.g., per Mb of data), wireless replacement cost trends, etc. With CostQuest’s vast data repository of costs at a very granular level, as well as, available public data, tailor-made trend analyses specific to a client’s needs can be developed.

For more information regarding our cost models and services, contact Mike Wilson or fill out our Contact Us form.